Chapter 1: A View of the UAS Market

Student Learning Objectives – The student will gain an understanding of the current UAS marketplace and barriers to UAS growth. Students will be introduced to the UAS cybersecurity issues in the UAM sector.

Marketplace History

Consider the US marketplace for UAS. The US UAS marketplace is comprised of three UAS sectors: commercial, consumer, and military. The UAS marketplace has evolved from the military to commercial rapidly over the last four years. Technological advancements for unmanned space vehicles has contributed to the rapid growth and opened new markets for UAS sales. Projections are for the UAS market to reach approximately $12 billion in 2021.[1]

Is the UAS marketplace growing faster than we can secure? UAS technology growth in the consumer sector has a 40% compound annual growth rate.[2] Commercial UAS registration was mandated after April 2016. FAA reported that they received about 1,000 registrations a week. In 2017, UAS registrations exceeded 150% from 2016.[3] See Figure 1-1. In 2015, the first year of –the UAS market growth, security researchers at DEF CON[4] successful knocked an A.R. drone[5] out of the sky.

Figure 1-1 Consumer sUAS registration as of December 31, 2017

Source Figure 1-1: United States Department of Transportation (2015 -2018, August 4). Federal Aviation Administration. URL: Retrieved June 2018, from Federal Aviation Administration: https://www.faa.gov/news/updates/?newsId=83395 (United States Department of Transportation, 2015 -2018)[6],[7]

UAS Marketplace Drivers

Key drivers in the development of the US UAS marketplace are: FAA regulations, public acceptance, national / state infrastructure, and advancements in technology. The FAA regulatory environment, state law and international laws concerning UAS will be presented in Chapter 2. The key goal for all UAS regulations is the safe integration of UAS into the national airspace.

Public Acceptance

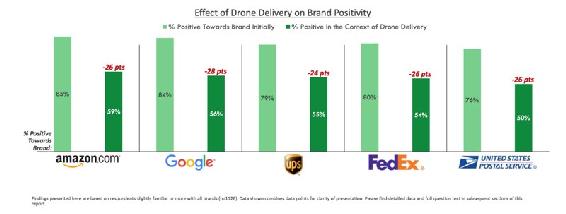

Before the retail marketplace can grow there needs to be a public acceptance of the UAS services. In 2016, the Inspector General of the United States Postal Service Office administered an online survey regarding UAS among 18-75-year-old residents in all fifty states and the District of Columbia.[8] The findings paint a picture of uncertainty of nationwide acceptance. Overall, the three generational groups (Baby Boomers,[9] Generation X,[10] and Millennials[11] think it is too soon for UAS delivery. Millennials are the largest U.S. population that would accept the concept of drone delivery. Forty-eight percent of Millennials believe it would be “safe” to integrate UAS systems into the National Airspace (NAS). This compares to 47 % of Baby Boomers that believe delivery of a package by UAS would be “unsafe.”[12] All three generational groups chose Amazon as their trusted brand for drone delivery.[13] “Baby Boomers” traditionally are more conservative than other generations. For this reason, the US UAS marketplace growth may be delayed.

Figure 1-2 U.S. Postal Service Survey Results

Source: United States Postal Service Office of Inspector General (2016, October 11). Retrieved June 2018, from Public Perception of Drone Delivery in the United States: https://www.uspsoig.gov/sites/default/files/document-library-files/2016/RARC_WP-17-001.pdf

Infrastructure Influence

Along with government regulations, infrastructure in the U.S. has been a roadblock when it comes to growth of the UAS market in the U.S. The U.S. aviation infrastructure ranks low among other countries around the globe.[14] According to the Air Help global survey,

With poor infrastructure, the UAS industry has an uphill battle in building a diverse marketplace in the U.S. To mitigate falling behind in the global UAS commercial market private corporations have taken the U.S. infrastructure issue into their own hands. “Amazon, Google, Boeing and General Electric have joined forces with NASA to build out a privately funded and operated air-traffic control network separate from current federal system.” (Pasztor, 2018) One reason for the private industry taking the lead, is it is recognized that FAA is not able to process requests from commercial drone operators fast enough and/or reject a large amount of applications. The current air-traffic control system is not compatible with the Low Altitude Authorization and Notification Capability (LAANC) that is needed to safely operate commercial UAS traffic in a highly populated area. U.S. will need to allocate more money and resources in UAS infrastructure to keep up with the globe.

Restricting Drones Flight

Some states have taken a negative view of UAS activity and have legislated restrictions on their use. See Figure 1-3.

There are areas of restricted air space that UAS / drones are not permitted to enter or operate. It could be restricted for protection of the U.S. government or stealing plays of a major league football team. While a majority of UAS manufacturers have built in GPS Geofencing.[15] this is not a “silver bullet” solution. Different methods of preventing drones in restricted areas are being tested. Airspace Systems has created a drone with sensors and artificial intelligence, to prevent unwanted drones.[16]

Figure 1-3 State of Florida Drone Signage

Source: State of Florida Drone Signage. Dixon, D. (August 1, 2017) The Florida Times-Union, Jacksonville. Geofencing Stops Drones in Their Tracks. http://www.govtech.com/public-safety/Geofencing-Stops-Drones-in-Their-Tracks.html

The defensive drone, named Avlayan, is capable of high speed travel and uses a Kevlar net to capture the threatening drone away from the area. See Figure 1-4. Another drone blocking innovation is the SkyDroner camera, it detects and disables drones that enter an area.

Commercial

Commercial UAS use in the U.S. has primarily been limited due to FAA regulations. As a result, U.S. companies have gone abroad to Europe, Africa, and Asia to test their drone functionality and begin commerce. Recently the FAA began to change regulations in favor of the UAS commercial market, however the change remains behind other countries. The U.S. commercial market consists of the following sectors: movie / film, agriculture, humanitarian aid, and retail industries. Retailers, like Amazon and FedEx, are exploring UAS delivery of goods to and services to consumers. UAS used for humanitarian efforts are moving at an accelerated pace through the FAA approvals. The U.S. remains behind in the global UAS race in the commercial market. The focus in the U.S. for commercial UAS remains on safety and pollution. The topic of security of the UAS is limited to military, law enforcement and intelligence organizations. The subject of security remains unaddressed at a formal level in the development of commercial UAS globally. Critical security factors of UAS could be used to develop the marketplace, allowing the U.S. to be an example for other countries.

Figure 1-4 Airspace Systems Interceptor autonomous aerial drone

Source: Drone-catchers Emerge on a New Aerial Frontier. (March 21, 2017). In Silicone Valley & Technology https://www.voanews.com/a/drone-catchers-emerge-new-aerial-frontier/3776609.html

Retail

In December 2016, Amazon successfully completed one of the first ever commercial deliveries in Cambridge, UK.[17] See example Figure 1-5. The U.S. based company chose to arrange the first delivery in the United Kingdom because of their regulations are ahead of the U.S. Amazon’s first U.S. delivery occurred in March 2017, which is behind other countries. In 2016, China’s largest ecommerce retailer began deliveries to customers. In 2016, Dominos started delivering pizzas to New Zealanders via UAS marketplace.

Figure 1-5 Amazon Prime Air

Source: Bishop, T. Geek wire (December 14, 2016). Video: Amazon makes first Prime Air drone package delivery, offers glimpse of new design https://www.geekwire.com/2016/video-amazon-makes-first-prime-air-drone-package-delivery-offers-glimpse-new-aircraft-design/

Overall, Africa is leading the UAS commercial market, they established a drone corridor and working on building out the first drone port.[18]

Zipline, a U.S. based UAS company, delivered blood to remote area of outside of Rwanda in 2016. Rwanda was chosen by the sky ambulance company because of the lack of established infrastructure. By the end of 2018, Zipline is projected to be the world’s largest drone delivery service. Zipline’s commercial drones, backed by UPS, can travel 500 flights a day up to 80 mph. It is expected Zipline will conduct 2,000 medical deliveries a day by the Tanzania government. Zipline’s currently planning to launch business in the U.S. by the end of 2018. The issue of security does not seem to be a Zipline priority. (Figure 1-6) This might be a grave concern in a country / continent which has so many terrorist groups in the field.

Figure 1-6 Zipline drone testing package drop

Source: Shankland, S. CNET (April 2, 2018). Zipline’s second-gen drones speed its medical delivery business. https://www.cnet.com/news/zipline-new-delivery-drones-fly-medical-supplies-faster-farther/

In May 2018, the FAA announce their UAS Integration Pilot Program (UASIPP), which is a program comprised of ten companies that would be paired with local governments to conduct commercial drone testing. Amazon, the world’s largest online retailer, and DJI were not chosen to take part in the pilot.[19] China’s DJI is the world’s top drone manufacture, owning 70% of the global marketplace.[20] Among the ten chosen companies to participate in the FAA test program are Apple, Intel, Uber, and Zipline.

UAS For Hire – Urban Air Mobility and E-VTOL

Often compared to The Jetsons, Urban Air Mobility (UAM) remains a far-reaching idea for the public. UAM can be a manned or unmanned flying vehicles that transport one to six people, without delay, unlike automobile traffic. However, the reality of UAM is closer than the public would chose to believe. Uber announced Uber Elevate in Fall of 2016. Consult Figure 1-8. Elevate is a project that will make UAM a “common household name”. Initially the project started with the idea of unmanned air vehicles landing on rooftops. Since the introduction of Elevate, it has evolved into so much more.

1-7 Uber Elevate

Source: Stewart, J. (2018, May 8), Wired. Retrieved July 2018, from Wired Transportation: https://www.wired.com/story/uber-unveils-flying-taxi/

Uber was one of the companies approved for commercial testing by the FAA as part of the UASIPP. This decision was a significant for the U.S. in the UAS race. Upon completion, Uber’s project Elevate will implement intra-city taxis that will be unmanned aerial vehicles. The technology is often referred to as Electric Vertical Take-Off and Landing (E-VTOL). This on-demand urban air taxi is fully electric and takes off and lands vertically. Uber is planning by 2023, to have a network of E-VTOLs distributed by vertiports. (Figure 1-7) The vertiports will have multiple takeoff and landing pads. The pads will be equipped with charging infrastructure. By 2030, Dubai is planning to be using E-VTOL to mobilize 25% of the population.[21]

Figure 1-8 Uber Flying Skies

Source: Stewart, J. (2018, May 8), Wired. Retrieved July 2018, from Wired Transportation: https://www.wired.com/story/uber-unveils-flying-taxi/

The consumer will be able to use their mobile device to request an Uber Elevate aircraft. After arriving at the vertiport, Uber’s version of an UAV airport, the consumer will be weighted as they check in and assigned an aircraft.

The consumer would then proceed to the assigned pad for departure.[22] (See Figure 1-8) The author believes, that if the U.S. government continues to support Uber UAS creativity, the USA would be a front -runner in the inter-city taxi industry. See Figure 1-9 for a look at the future Uber UAM station.

Figure 1-9 Uber UAM Station Check-in

Source: Stewart, J. (2018, May 8), Wired. Retrieved July 2018, from Wired Transportation: https://www.wired.com/story/uber-unveils-flying-taxi/

It is estimated there are fifty companies creating E-VTOL aircrafts globally. The designs vary from amount of motors, sensors, and propellers. As of 2017, the EHang 184 E-VTOL conducted numerous tests for Dubai’s Roads and Transport Authority (RTA). Passengers have been flown in China and Dubai. The aircraft is being developed in China and in Redwood City, California. The EHang 184 is a single passenger aircraft that has safety features such as sensors that prevent it taking off in a storm. See Figure 1-10.

Figure 1-10 EHang 184 E-VTOL

Source: EHang 184. Electric VTOL News by Vertical Flight Society (September 8,2018). Retrieved 09082018 from EVTOL News at: http://evtol.news/aircraft/ehang/

In comparison, the Volocopter holds two passengers and boasts eighteen electric drives. It is estimated the Volocopter can move 1,000 passengers an hour by landing on rooftops, or as the company calls them “Volo-ports”.[23] The aircraft uses a fly-by-light (FBL) communications network that includes Gyroscopes, acceleration sensors, magnetic field measurement sensors, and manometers.

UAS for hire is expanding to explore transporting more people for further distances. The Lilium is a five passenger VTOL, with the ability to move five times faster than a car. The unmanned taxi is estimated to transport from Manhattan to New York’s JFK airport in five minutes verse the fifty-five minutes by car.

E-VTOL Cybersecurity

Cybersecurity protection of E-VTOL data is not respected as an issue – even though millions of customers have suffered breaches of personal data by well-respected companies. NASA is leading a series of workgroups to research areas of pollution, and safety. Only recently has NASA integrated cybersecurity with the addition of one researcher. The hype to bring UAM to the marketplace has blinded the industry of reviewing the cybersecurity implications. The industry should learn from others that have come before them. Let’s look at the Tesla company.

In 2016, Tesla launched the first self-driving car. The automaker has been in the electric car business since 2008. They only became popular in 2015, selling over 50,000 vehicles.[24] It took less than a year from record sales for the car to be compromised. Hackers were able to take remote control of a Tesla Model S from twelve miles. They were able to operate the brakes, door locks, dashboard computer screen and other electronically controlled components.[25] [26]

Additionally, another group from University of South Carolina made the car’s autopilot believe it was seeing objects that were not actually there, causing the car to brake prematurely (Solon, 2016). Tesla does run a bug bounty program, however their plan for ensuring security of the car was flawed. In 2017, the Tesla Model X was again compromised, turning on the brakes remotely and getting the doors and trunk to open and close while blinking the lights in time to music streamed from the car’s radio.[27] See Figure 1-11. Both compromises were completed by Keen Security Lab of Shanghai, China. As a result, Tesla released a statement, “They actively encourage this type of research so that it can prevent potential issues from occurring. The risk to customers from such exploits is very low and Tesla has not seen a single customer ever affected by it.”[28] [29]

Figure 1-11 Model X 2017

Source: Tesla (September 8, 2018) Tested: Driving the Tesla Model X w/ Autopilot! Youtube.com via https://www.f-sport.lt/play/5670542/tested-driving-the-tesla-model-x-w-autopilot.html

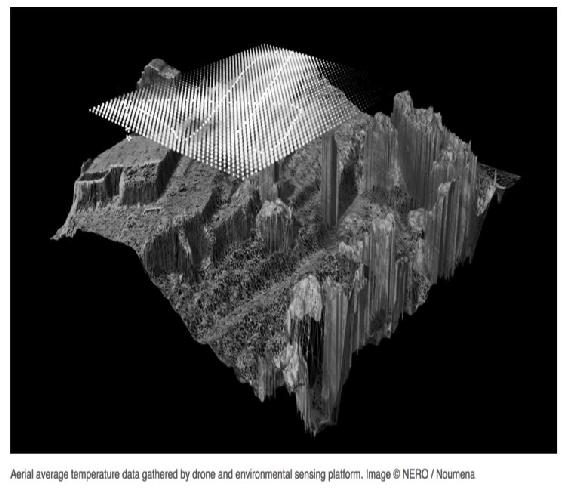

Agriculture

Agriculture is the fastest growing industry in the UAS commercial market. Drones equipped with sensors are used for monitoring crops and providing soil analysis. Outside of the U.S. UAS are used to apply fertilizer, pesticides, and irrigate crops. Farm animals can be tracked, and health monitored by data collected by drones. A leading agriculture drone provider, Agribotix, has created FarmLens. The cloud-based solution provides extensive data to the farmer regarding their crops. This product is part of a partnership with AgrAbility, enabling farmers with disabilities to continue in their profession. See Figure 1-12 for temperature study data for an environmental permitting process performed by drone and analyzed by Nero software.

Architecture and Construction

The construction sector is projected to be the largest commercial buyer of UAS, totaling $ 11.2 billion globally by 2021.[30] Architects use drones for site scanning, feasibility studies, and presenting the client with the first virtual images of what the site will look like at completion. The designers can use thermal imaging and multispectral cameras to provide critical data about the land prior to building. Builders can use drones during the construction process to track progress, monitor assets, and capture issues prior to inspection. Inspectors are able to use drones to monitor for compliance to building regulations. After the construction is complete, the collection of drone data can be used in selling the property. Currently, real estate agents are using drones to enhance their business by providing aerial views of property for their consumers.

Figure 1-12 Nero temperature data collection

Source: NERO / Noumena (12-14th of February 2016). Temperature Data Captured Through Environmental Sensing Platform (Smart Citizen Kit) And Drone, Mapping Location: Ctra. BV-1415 (Horta-Cerdanyola), km 7,08290 Cerdanyola del Vallès, Barcelona – Spain https://noumena.io/11545-2/

Chinese drones

The global consumer market for drones continues to grow. Since the development of the DJI drone in by Frank Wang 2006, as part of his graduate thesis, the company holds 70% of the consumer marketplace. (Gan, 2018) See Figure 1-13. In 2017, DJI had $2.7 billion in sales comprised of 30% of its revenues from China, the US, and Europe, respectively, and 10% from South America.[31] Their manufacturing capabilities, infrastructure, and logistics is the key to China remaining a market leader in the consumer space. The U.S. has outsourced much of their manufacturing, therefore weakening their ability to produce and get to market in a timely manner. Additional, China has a large test market, supporting infrastructure, and consumer support. The U.S. continues to find it difficult to keep up in all areas.

Figure 1-13 DJI Founder Frank Wang

Source: DJI. In Fortune, The Unicorn List. Retrieved September 09, 2018 http://fortune.com/unicorns/dji-16/

The U.S. consumer uses the drone primarily for photography and film. There are a number of drone hobbyists as well. Overall the impact to consumer grow has been stifled in the U.S. for same reasons as commercial market. The increasing regulations on UAS, across all sizes, has changed the consumer market in the U.S. The FAA has implemented the same risk assessments across all drones, limiting the marketplace. A consumer drone can be treated the same as an emergency services drone.

The inability to change the process to recognize distinct UAS markets in the U.S. will continue to have dramatic impact. The marketplace for UAS is as wide as the imagination, however the U.S. barriers of regulation, infrastructure, and technology advancements will place them behind less developed countries.

Discussion Questions

- What are the impacts to the U.S. if the country is unable to keep up with the growth of UAS?

- How can security be included in the development of a product without having an impact in the race to market?

- What do you think about the security legacy issues for UAS components? How could It be improved by building in security up-front AND controlling the manufacturing supply chain? See: Dr Julie J.C.H. Ryan’s PDF class handout on “An Exploration of Information Security Aspects Julie J.C.H. Ryan” [Also available by contacting Professor Nichols at KSU.]

Bibliography

Bishop, T. (2016, December 14). Amazon makes first Prime Air drone package delivery. Retrieved from Geek Wire: https://www.geekwire.com/2016/video-amazon-makes-first-prime-air-drone-package-delivery-offers-glimpse-new-aircraft-design/

Borak, M. (2018, January 3). Tech Node. Retrieved June 2018, from World’s Top Drone Seller made $2.7 billion: https://technode.com/2018/01/03/worlds-top-drone-seller-dji-made-2-7-billion-2017/

Dimock, M. (2019, January 17). Defining generations: Where Millennials end and Generation Z begins. Retrieved from Pew Research Center: https://www.pewresearch.org/fact-tank/2019/01/17/where-millennials-end-and-generation-z-begins/

Dixon, D. (2017, Aug 1). State of Florida Drone Signage. Retrieved from Government Technology: http://www.govtech.com/public-safety/Geofencing-Stops-Drones-in-Their-Tracks.html

Gan, J. (2018, July 02). Harvard Business Review. Retrieved July 2018, from Harvard business Review Innovation: https://hbr.org/2018/07/the-factors-behind-chinas-growing-strength-in-innovation

Geo-Fencing Definition. (2019, July 18). Retrieved from Whatis.TechTarget.com: https://whatis.techtarget.com/definition/geofencing

Global Market Insights, Inc. (2018, February 26). Global Market Insights. Retrieved June 2018, from Commercial Drone / UAV Market worth over $17bn by 2024: https://www.gminsights.com/pressrelease/unmanned-aerial-vehicles-UAV-commercial-drone-market

III, W. B. (2018, June 1). Aviation Today. Retrieved July 2018, from Avionics Magazine June/July: http://interactive.aviationtoday.com/avionicsmagazine/june-july-2018/avionics-for-2020s-evtol-and-supersonic-aircraft/

Mannes, J. (2016, November 18). Tech Crunch. Retrieved June 2018, from sensors and machine intelligence, to autonomously intercept threatening drones at high speeds and carry them away from large crowds: https://techcrunch.com/2016/11/18/airspace-systems-interceptor-can-catch-high-speed-drones-all-by-itself/

Markovich, S. (2015, May 28). Council on Foreign Relations. Retrieved July 2018, from U.S. Aviation Infrastructure: https://www.cfr.org/backgrounder/us-aviation-infrastructure

Meola, A. (2017, July 13). Business Insider. Retrieved June 2018, from Drone market shows positive outlook with strong industry growth and trends: http://www.businessinsider.com/drone-industry-analysis-market-trends-growth-forecasts-2017-7

Pasztor, A. (2018, March 9). Wall Street Journal. Retrieved July 2018, from Business Wall Street Journal: https://www.wsj.com/articles/amazon-google-others-are-developing-private-air-traffic-control-for-drones-1520622925

Rizzo, C. (2018, June 6). Travel and Leisure. Retrieved July 2018, from Airlines and Airports: https://www.travelandleisure.com/airlines-airports/most-least-punctual-airports-airhelp-study

Shahan, Z. (2016, January 5). Clean Technica. Retrieved July 2018, from Clean Technica Transport: https://cleantechnica.com/2016/01/05/tesla-surpasses-50000-sales-in-2015/

Shankland, S. (2018, April 2). Zipline’s second-gen drones speed its medical delivery business. Retrieved from CNET : https://www.cnet.com/news/zipline-new-delivery-drones-fly-medical-supplies-faster-farther/

Shepardson, D., & Dastin, J. (2018, May 9). Reuters. Retrieved July 2018, from Technology News: https://www.reuters.com/article/us-usa-drones-companies/u-s-drone-program-taps-apple-passes-over-amazon-chinas-dji-idUSKBN1IA2WC

Solon, O. (2016, September 20). The Guardian. Retrieved July 2018, from The Guardian US World Envionment: https://www.theguardian.com/technology/2016/sep/20/tesla-model-s-chinese-hack-remote-control-brakes

Stewart, J. (2018, May 8). Wired. Retrieved July 2018, from Wired Transportation: https://www.wired.com/story/uber-unveils-flying-taxi/

Tech Musings. (2009, December 18). Pingdom. Retrieved June 2018, from Worst Internet disasters of the decade: https://royal.pingdom.com/2009/12/18/worst-internet-disasters-of-the-decade/

Tesla . (2018, September 8). Tested: Driving the Tesla Model X w/ Autopilot! . Retrieved from F Sport: https://www.f-sport.lt/play/5670542/tested-driving-the-tesla-model-x-w-autopilot.html

United States Department of Transportation. (2015 -2018, August 4). Federal Aviation Administration. Retrieved June 2018, from Federal Aviation Administration: https://www.faa.gov/news/updates/?newsId=83395

United States Postal Service Office of Inspector General. (2016, October 11). United States Postal Service Office of Inspector General. Retrieved June 2018, from Public Perception of Drone Delivery in the United States: https://www.uspsoig.gov/sites/default/files/document-library-files/2016/RARC_WP-17-001.pdf

Weise, E. (2017, July 28). USA Today. Retrieved July 2018, from USA Today Tech: https://www.usatoday.com/story/tech/2017/07/28/chinese-group-hacks-tesla-second-year-row/518430001/

Wood, H. (2018, April 4). Archinect. Retrieved July 2018, from Archinect: Features – Drones for Architects: https://archinect.com/features/article/150058176/drones-for-architects-new-capabilities-for-the-construction-sector-how-to-get-started-and-how-to-navigate-the-law

- Meola, 2017. (Tech Musings, 2009) ↵

- IBID ↵

- (United States Department of Transportation, 2015 -2018) ↵

- DEF CON is the world’s longest running and largest underground hacking conference. ↵

- AR drone. AR stands for “Augmented Reality” in AR drone. AR Drone can perform tasks like object recognition and following, gesture following. ↵

- IoT Internet of things ↵

- Green circles represent hub-densities of UAS registrations. ↵

- (United States Postal Service Office of Inspector General, 2016) ↵

- Wikipedia (2018) Baby Boomers are generally defined as those born between 1945 and 1964. That would make the generation huge (71 MM) and encompass people who were 20 years apart in age. ↵

- IBID, Generation X, or Gen X, is the demographic cohort following the baby boomers and preceding the Millennials. There are no precise dates for when Generation X starts or ends. Demographers and researchers typically use birth years ranging from the early-to-mid 1960s to the early 1980s. ↵

- IBID, anyone born between 1981 and 1996 (ages 22 to 37 in 2018) will be considered a Millennials ↵

- Safe and unsafe are relative terms. No definition was given in the survey. This presents a problem for the researchers because of the vagueness of the terms. ↵

- Op cit. (United States Postal Service Office of Inspector General, 2016) ↵

- (Markovich, 2015) ↵

- “A geo-fence is a virtual perimeter for a real-world geographic area. A geo-fence could be dynamically generated—as in a radius around a point location, or a geo-fence can be a predefined set of boundaries (such as school zones or neighborhood boundaries). The use of a geo-fence is called geo-fencing, and one example of usage involves a location-aware device of a location-based service (LBS) user entering or exiting a geo-fence. This activity could trigger an alert to the device’s user as well as messaging to the geo-fence operator. This info, which could contain the location of the device, could be sent to a mobile telephone or an email account.” (Wiki-G, 2018) ↵

- (Mannes, 2016) ↵

- (Global Market Insights, Inc., 2018) ↵

- The UAS African connection is much more complex than just retail entities. See Chapter 15: Africa – World’s First Busiest Drone Operational Proving Ground – Where Counter-Terrorism and Modernization Meet ↵

- (Shepardson & Dastin, 2018) ↵

- (Borak, 2018) ↵

- (Stewart, 2018) ↵

- (Stewart, 2018) ↵

- (III, 2018) ↵

- (Shahan, 2016) ↵

- (Solon, 2016) ↵

- This was an impressive hack and should give intelligence personnel a pause. ↵

- (Weise, 2017) ↵

- (Weise, 2017) ↵

- This was clearly a legal CYA for incompetence in their security cyber-protections of their own product. ↵

- (Wood, 2018) ↵

- (Gan, 2018) ↵